Guide to Home Insurance in Portugal

Guide to Home Insurance in Portugal

You’ve made the decision. You’re moving to Portugal and are going to take total advantage of its relaxed way of life, sun, beaches, golf courses… But before going any further, it’s best to have all the administrative issues straight like home insurance! Whether you’re renting or own your new home, you must ask yourself a few good questions in order to insure it: “What’s the process? What’s the cost? With who? Read our Guide to Home Insurance in Portugal for the answers.

Why get home insurance in Portugal?

Because, just like when you’re in England, your new home won’t be completely safe from a leak, a burglary or a weather event that may damage the structure and/or the property in your home…

Whether an owner or tenant, home insurance brings peace of mind: it guarantees the structure of your home as well as your possessions in addition to covering the civil liability of the occupants and even that of your 4-legged friends!

I heard home insurance is not mandatory in Portugal

That’s true… As a tenant in Portugal, you have no obligation to take out home insurance. However, home owners are required to insure their assets against the risk of fire and the property manager must ensure the common areas are covered by insurance.

So, why should I insure my home in Portugal if it’s not mandatory?

For peace of mind and to guarantee peaceful relations with your neighbours and with your landlord!

In fact, no one is completely safe from a burglary or a “minor everyday accident” (an overflowing bathtub, a leaking washing machine…) that may damage your home as well as your neighbours’ homes. When that happens, who pays for the repairs and at what cost? Without home insurance, you may quickly find yourself in a conflictive situation and you still may not really be proficient in your host country’s language! Insuring your home is all about investing in a guarantee of peace, especially when you’re abroad.

What other benefits are there to home insurance?

Home insurance is much more than just insuring your furniture … In fact, home insurance is also known as home multi-risk. This means it covers all sorts of risks ranging from breaking and entering to fire, water damage and electrical damage following a big storm… And even Civil Liability (CL) for the insured and the people declared under the same roof.

Civil Liability covers all bodily injuries and material and non-material damages caused to another person in one’s private life.

Did you know?

In Portugal, it is quite easy to find qualified domestic help at a much lower cost than in England: cleaners, childcare, gardeners, etc. But, did you know that you are required to take out occupational accident insurance to cover your employees when working in your home as well as when they’re traveling to and from work?

Get more information from our INOV Expat specialists…

To better understand your premium, you need to know how it’s calculated and ask a few good questions :

-

Do you rent or own your home in Portugal?

If you’re the home owner… The premium is generally higher as the cover is broader: it even includes structural insurance, for example. If you’re the home owner and occupant, insurance may also cover the furniture.

-

Is it your primary or secondary residence?

If it’s a secondary residence which is only occupied a few weeks a year, the premium will be higher! In fact, the risk of a potential theft increases when your property has no surveillance or occupants for long periods of time and that is why the premium is higher. Other factors will also influence the cost of the premium: the surface area of the home, outbuildings, a swimming pool…

-

Where do you live?

Your place of residence has a significant impact on the cost of your premium. Insurance companies cover risks by calculating based on objective statistical data as far as the number of reported violations in the surrounding area. The premium should be less in a rural area in comparison to a home in an urban area.

-

Is it a house, a flat… big or small?

The premium for your home insurance is calculated based on the number of rooms to be insured. For example, a studio flat in the Chiado district in Lisbon would be less expensive to insure than a family home with a swimming pool and an outbuilding in Cascais or Faro since the risk of damage is statistically lower… Insurance companies also take into account the value of the fixed assets (owner) and non-fixed assets (tenant) at the property to be insured.

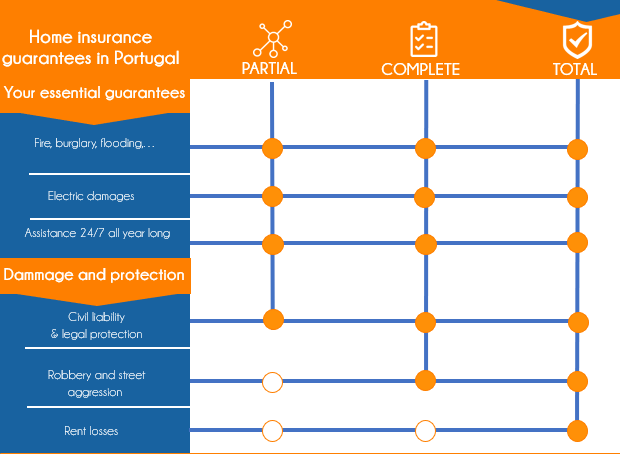

To get an idea of the different offers, here’s a little diagram with the 3 main types of home insurance policies you may find in Portugal :

What about buying a home… is it really all that complicated in Portugal?

Rather than renting, you’d prefer to take advantage of the buoyant estate situation and relatively affordable prices by investing in a new home…

The various steps:

-

Get assistance from a professional

Finding a local representative (an attorney, an agent broker or a Portuguese notary) is essential given the various steps that must be taken if you wish to buy and even more so if you aren’t proficient in Portuguese.

-

Conservatora do registo Predial

Once you’ve found your dream home, the land registry (Conservatora do registo Predial) must be checked to ensure the ownership status is correct without any burdens or mortgages that may get in the way of the sale.

-

Get a Taxpayer’s Number (Finanças)

This is a card that shows your taxpayer’s number. This document is essential to pay your annual property taxes but also for certain everyday tasks like opening an account with a Portuguese bank.

-

Cadastre (Carderneta Predial)

It is important to check with the local cadastre to ensure all the information registered corresponds with the information you’ve been given – number of rooms, surface area of the property, surface area of the garden, etc.

-

Promise to Sell (Contracto de Compra e Venda)

At this point, you’ll probably need to pay the seller (via their attorney) a deposit of 10% of the purchase price. The corresponding contract may be signed before a notary or an attorney.

-

Transfer duties= IMT (formerly known as SISA)

IMT is the Portuguese property transfer duty and it must be paid before signing the bill of sale. The sum varies based on the property value.

- Property taxes (IMI)

Careful! Before signing any actual bill of sale, you must have your attorney or representative verify the seller is current on property taxes (for the last 5 years) … or you’ll be at risk of having to pay them yourself.

- Definitive bill of sale (Escritura)

The land patent is issued along with the definitive bill of transfer which is signed at a notary’s office.

- Registration

The transfer of ownership must be registered with the local land registry so your name is listed as the new owner.

Why choose INOV Expat to help you choose your home insurance in Portugal?

You probably now understand that insuring you property means taking the time to ask good questions and compare offers. But, it’s not always so easy to know who to trust with these types of guarantees when you arrive in a new country and haven’t got the time to handle all the administrative issues and even less so when you still aren’t proficient in the language…

INOV Expat is right there to meet this need: giving you the best advice on insurance, in English and for free! In fact, after 14 years, INOV Expat, an insurance brokerage firm, specialises in insurance for French and English-speaking expatriates in Spain, and now in Portugal, at their destinations. As insurance professionals, we’ve signed partnership agreements with the best insurance companies in the market.

All INOV Expat consultants are expatriates who perfectly understand your problems and are there for you to offer free advice in the language of your choice.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance or contact us by email at welcome@.inovexpat.com.

![]()