Life insurance quote in Portugal

Life insurance in Portugal holds no secrets for Inov Expat, which will be able to guide you to finding the best life insurance for you and your family.

Complete the following form to receive a comparison of the best policies on the market, adapted to your needs within 2 hours (during office hours); your life insurance quote in Portugal is free:

More information about life insurance in Portugal

In order to be able to choose the right life insurance in Portugal for your needs, you first need to know how it works. Life insurance is personal insurance that covers the risks connected with the insured party’s disability or death. The main purpose of this type of insurance is for the insured party to guarantee their own financial security in the event of a disability and the financial security of their dependents in the event of the insured party’s death.

With this type of insurance, there are 3 possible intervening parties:

The policyholder: the person who signs and pays for the insurance policy

The insured party: The disability and/or death of the insured party are covered and determine the value of the insured capital

The beneficiary: the person who receives an indemnity in the event of the death of the insured party

Even though there are many, we offer explanations below of the two main types of existing life insurance policies:

- Temporary life insurance: a periodic premium is paid for a guaranteed capital in the event of death or disability. The policy is renewed annually and the premium increases every five years based on the insured party’s age.

- Payment protection (or fixed premium) life insurance: a constant premium is paid for a defined term. This type of insurance is mostly used with real estate mortgages.

When is it a good idea to take out a life insurance policy?

- You are the head of household and wish to guarantee your children’s future in the event of your death.

- If you exercise a risky profession, you constantly drive or do any extreme sports.

- You have purchased real estate through a bank loan and wish to guarantee repayment of the loan in the event of an accident or illness.

- You are young and wish to protect yourself against a disability or illness that may affect your professional career.

- You are a key person in your company and wish to guarantee its continuity in the event of your death or disability.

- You are a partner in a company and wish to guarantee other partners the possibility of purchasing your stakes in the event of your death.

These are just a few examples to illustrate the many possibilities of this type of insurance which is the only kind that covers you and your family or those that depend on you.

Don’t think twice about contacting us so we can find the most appropriate life insurance solution for your situation together.

If you’d like to know more about life insurance, we invite you read our article “insuring life" where many of the questions you still may have regarding this very important type of insurance are answered.

Inov Expat

We are an insurance broker that has been working with the best insurance companies in the market since our foundation in 2004 to be able to offer you a life insurance solution that is particularly well adapted to your needs and at the best price. We can answer all your questions as well as handle any claims necessary throughout the term of your life insurance policy and act as privileged liaisons to defend your rights against insurance companies. Our service is free.

Search

Articles

Guide to Automobile Insurance in Portugal

Guide to Automobile Insurance in Portugal

To better understand automobile insurance in Portugal, we’d like to first remind you of the principles of automobile insurance and then we’ll give you all the details of the different administrative procedures required before insuring your vehicle.

To protect yourself in the event of an accident, theft or simply a blow to your windshield, automobile insurance gives you the guarantees you need to drive peacefully. Besides insuring the driver and all passengers, automobile insurance also covers the driver’s civil liability for damages caused to third parties.

To drive in a zen state of mind, make sure you’re well-insured!

Insuring your vehicle in Portugal: an obligation?

In Portugal, even insuring your car is subject to the law.

In fact, just like in England or in Spain, for example, Portuguese law requires car owners insure their vehicles with at least “third-party” insurance. This minimum guarantee, also known as “automobile civil liability” covers the costs of any material damages or bodily injuries the driver may cause to third parties. However, there are several options available to complete this basic guarantee and expand the cover for the insured vehicle (see the section “choosing good automobile insurance”).

How is the price of my automobile insurance calculated?

The sum of the premium for your automobile insurance in Portugal depends on the type of guarantees chosen (third-party, standard or all-risk) but also your driving record; in other words: your age, the number of years you have had a licence, your driving history with former insurance companies (bonuses/penalties), the use of your vehicle in Portugal.

Did you know?

If you have lived in a European country for at least 6 months, you can take a driving exam… it’s easier to pass your exam in Portugal than in France and it costs less!

And for those who still don’t speak Portuguese, some driving schools offer driving courses in French (for a higher fee): the practical exam, however, will be in Portuguese!

How do you insure your vehicle?

1st step: change the plates…

Now living in Portugal, you wish to keep your favourite car: your old insurance may cover you for a maximum of 3 months. So, you need to take advantage of this period to apply to change your registration plates with the Portuguese authorities. We’ll give you all the details on the different steps, which sometimes require a little patience… (private intermediaries, however, can do this work for you for a fee of around €500).

- Obtain the certificate of conformity (builder’s site)

- Complete an IMT form 9 (downloadable doc in Portuguese)

- Take your vehicle to pass a technical inspection (authorised centres)

- Apply for approval of your vehicle (through the IMT office closest to your place of residence)

- Legalise your vehicle and pay ISV (vehicle tax) – A customs office corresponding to your place of residence

- Apply for a new grey card (IMT)

- Register your new registration plates with the Conservatoria do registo Automovel

2nd step: choose good automobile insurance

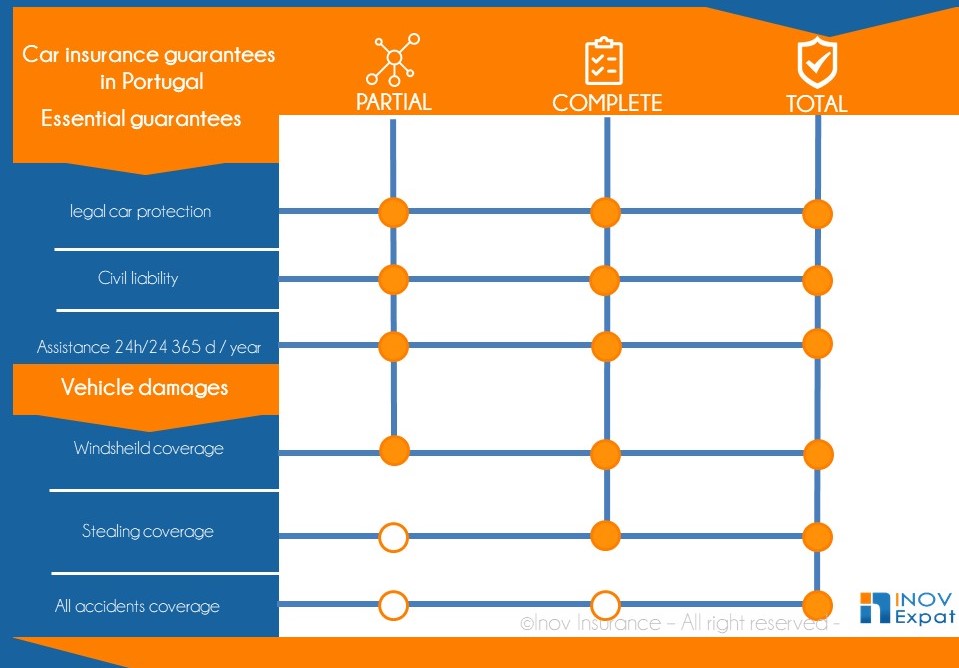

The automobile insurance policies you’ll be offered may be divided into 3 major categories: Basic-Standard-All risk :

Ask your free car insurance quote just HERE

3rd step: Documentation

To take out an automobile insurance policy in Portugal, you must provide the following documents to your insurance company or broker

- Taxpayer’s ID number (Numero de contribuinte)

- A mailing address in Portugal

- A bank account number in Portugal

- Your driving history with bonuses/penalties (ask your former insurance company)

- The grey card for your vehicle now registered in Portugal or the official documentation proving you’ve applied for a change of registration through the Portuguese authorities.

Why can INOV Expat offer you good automobile insurance solutions?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Spain, and now in Portugal, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex. So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free quote online: automobile, health, home, business, travel, other insurance. Check our website: pt.inovexpat.com or contact by email welcome@pt.inovexpat.com.

![]()