Why take out Travel Insurance?

Why take out Travel Insurance?

Traveling is about having adventures… But, sometimes there are troubles too: flight cancellations and delays, lost luggage, a stolen passport, health issues… Whether on business or traveling for pleasure, a trip abroad can become a nightmare with major unexpected costs.

Travel insurance is all about taking off with peace of mind

There are several formulas that cover the following risks in particular:

- Medical, surgery and hospitalisation fees up to €100,000

- Unlimited repatriation costs

- Other options may cover lost luggage, trip cancellation costs, dental emergencies and civil liability abroad (including material damages and bodily harm) caused to third parties during your stay

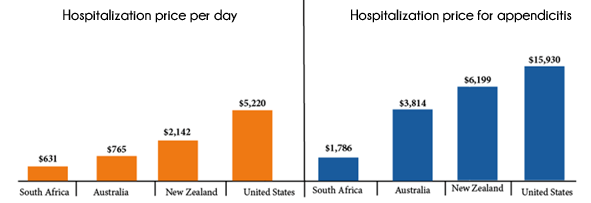

Here are two examples of healthcare costs at different destinations:

We always advise you to adapt your travel insurance policy to your “traveller” profile:

- For those who worry more about medical care (covering medical costs while traveling as well as repatriation), you should choose a medical care

- For travellers looking for expanded cover for all risks during travel, then multi-risk travel insurance should be the choice

- Travel insurance plans are custom-designed and adapt to your needs, whether a short or long stay or a business, family or adventure trip

From the duration to the type of stay to the adapted guarantees, there are so many different options based on your destination and coverage needs. For frequent travellers and those who’d like to insure all the members of their family, there are also annual and family plans.

> Our advice when it comes to travel insurance: don’t act too quickly and take time to analyse the cover offered in relation to your “traveller” profile !

What are the covers and benefits of annual travel insurance?

This is the most complete travel insurance. It particularly covers the following:

- Medical costs abroad (medical care, surgery and hospitalisation) up to €100,000

- Emergency dental care

- Repatriation or medical transfers without any cost ceilings

- Extended stays due to illness or an accident

- Travel and accommodation fees for a family member in the event of an illness or accident

- An early return in the event of the death or the non-scheduled hospitalisation of a close family member

- Luggage search and delivery if lost

- Interpreter services for an emergency situation

What is the price for… annual travel insurance?

To travel with complete peace of mind, we strongly advice taking out a travel insurance policy… When the average cost of travel insurance for 15 days is €50, it seems quite reasonable to include this cost in your holiday budget.

Irrespective of the duration of your trip, your destination or the number of people to be insured, we’re there to find the best travel insurance for you.

> So, get your free quote by clicking right here!

INOV Expat – About Us

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Spain, and now in Portugal, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at welcome@inovexpat.com.

![]()