Home Insurance: Policies through your bank

Home Insurance: Policies through your bank You’ve just signed a mortgage with your new Portuguese bank and your banking advisor suggests you also take out home insurance at the same time to take advantage of a great interest rate… Is it a good or bad idea? It’s sure an easy way to finish... Continue reading→

Why take out Travel Insurance?

Why take out Travel Insurance? Traveling is about having adventures… But, sometimes there are troubles too: flight cancellations and delays, lost luggage, a stolen passport, health issues… Whether on business or traveling for pleasure, a trip abroad can become a nightmare with major unexpected costs. Travel insurance is all about taking off with... Continue reading→

Health Insurance in Portugal: How It Works

Health Insurance in Portugal: How It Works Beyond the tax benefits for pensioners, Portugal is attracting more and more European workers who are coming to work, develop a business and enjoy an excellent quality of life and some of the best sun in Europe. Some 500,000 French workers have chosen this new life as... Continue reading→

Guide to Home Insurance in Portugal

Guide to Home Insurance in Portugal You’ve made the decision. You’re moving to Portugal and are going to take total advantage of its relaxed way of life, sun, beaches, golf courses… But before going any further, it’s best to have all the administrative issues straight like home insurance! Whether you’re renting or own your... Continue reading→

Healthcare in Portugal

Healthcare in Portugal Pursuant to European provisions, English expatriates residing in Portugal shall be exclusively assigned to the Portuguese social security system and will, therefore, lose status as insured under the English system. Two healthcare systems co-exist in Portugal: the public healthcare system Serviço Nacional de Saúde (SNS), for the employed, pensioners and non-employed, and... Continue reading→

Guide to Health Insurance in Portugal

Guide to Health Insurance in Portugal Unlike in England where the two healthcare systems (public and private) co-exist with patient freedom of choice and guaranteed minimum cover by the social security system, the SNS (Servicio nacional de Saùde) in Portugal never reimburses private sector healthcare. In order for care to be covered by the... Continue reading→

How does the private healthcare system work in Portugal?

How does the private healthcare system work in Portugal? Just like in Spain and Great Britain, there are 2 healthcare systems that co-exist in Portugal: the public and the private healthcare systems. Thanks to European cooperation agreements, English expatriates may benefit from the Portuguese public healthcare system based on universal and nearly-free care. However,... Continue reading→

What exactly is a brokerage firm?

What exactly is a brokerage firm? Some ideas are hard to let go of… in insurance too! Many still believe “a broker obviously gets a commission as payment… so, I hardly see the point as it will be more expensive; just go directly to the insurance company! And their offer will obviously be less extensive... Continue reading→

Mutual benefit health insurance in Portugal

Mutual benefit health insurance in Portugal You’ve arrived in Portugal: a new life, new plans… but an allergy or a bad sunburn can easily remind you that you’re not safe from a little weakness health-wise. To get the most out of your new expatriate life, it’s better to understand the Portuguese healthcare system which... Continue reading→

Motorbike Insurance in Portugal : Know and Understand All the Ins and Outs

Motorbike Insurance in Portugal : Know and Understand All the Ins and Outs Avoid the traffic jams, enjoy the exceptional sun and excellent quality roads… with a love for speed, you know your motorbike will be your preferred means of transport in Portugal whether travelling to work or getting away on the Marginal Road... Continue reading→

Search

Articles

Guide to Automobile Insurance in Portugal

Guide to Automobile Insurance in Portugal

To better understand automobile insurance in Portugal, we’d like to first remind you of the principles of automobile insurance and then we’ll give you all the details of the different administrative procedures required before insuring your vehicle.

To protect yourself in the event of an accident, theft or simply a blow to your windshield, automobile insurance gives you the guarantees you need to drive peacefully. Besides insuring the driver and all passengers, automobile insurance also covers the driver’s civil liability for damages caused to third parties.

To drive in a zen state of mind, make sure you’re well-insured!

Insuring your vehicle in Portugal: an obligation?

In Portugal, even insuring your car is subject to the law.

In fact, just like in England or in Spain, for example, Portuguese law requires car owners insure their vehicles with at least “third-party” insurance. This minimum guarantee, also known as “automobile civil liability” covers the costs of any material damages or bodily injuries the driver may cause to third parties. However, there are several options available to complete this basic guarantee and expand the cover for the insured vehicle (see the section “choosing good automobile insurance”).

How is the price of my automobile insurance calculated?

The sum of the premium for your automobile insurance in Portugal depends on the type of guarantees chosen (third-party, standard or all-risk) but also your driving record; in other words: your age, the number of years you have had a licence, your driving history with former insurance companies (bonuses/penalties), the use of your vehicle in Portugal.

Did you know?

If you have lived in a European country for at least 6 months, you can take a driving exam… it’s easier to pass your exam in Portugal than in France and it costs less!

And for those who still don’t speak Portuguese, some driving schools offer driving courses in French (for a higher fee): the practical exam, however, will be in Portuguese!

How do you insure your vehicle?

1st step: change the plates…

Now living in Portugal, you wish to keep your favourite car: your old insurance may cover you for a maximum of 3 months. So, you need to take advantage of this period to apply to change your registration plates with the Portuguese authorities. We’ll give you all the details on the different steps, which sometimes require a little patience… (private intermediaries, however, can do this work for you for a fee of around €500).

- Obtain the certificate of conformity (builder’s site)

- Complete an IMT form 9 (downloadable doc in Portuguese)

- Take your vehicle to pass a technical inspection (authorised centres)

- Apply for approval of your vehicle (through the IMT office closest to your place of residence)

- Legalise your vehicle and pay ISV (vehicle tax) – A customs office corresponding to your place of residence

- Apply for a new grey card (IMT)

- Register your new registration plates with the Conservatoria do registo Automovel

2nd step: choose good automobile insurance

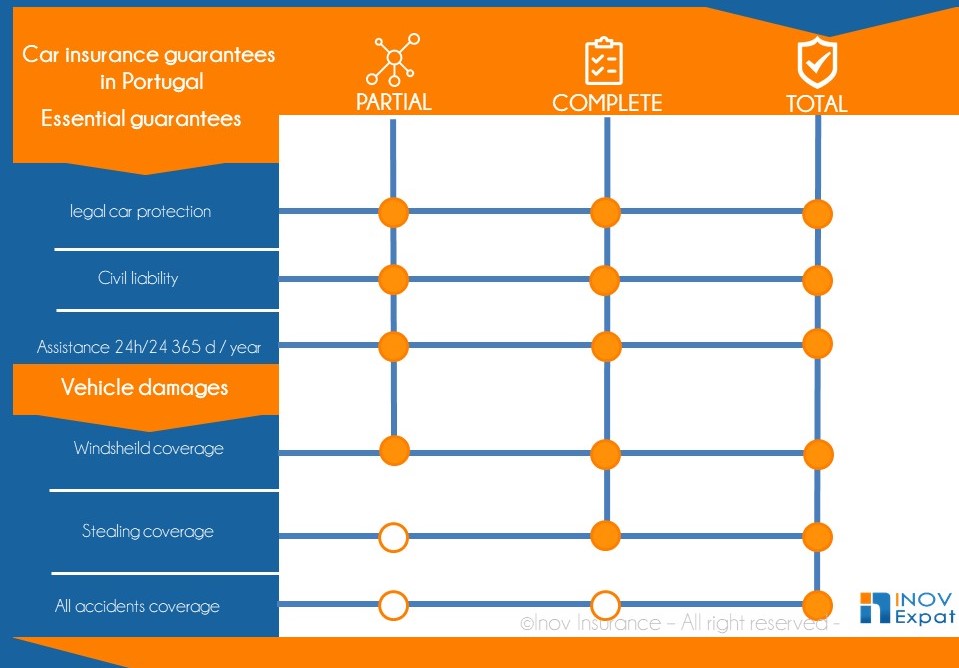

The automobile insurance policies you’ll be offered may be divided into 3 major categories: Basic-Standard-All risk :

Ask your free car insurance quote just HERE

3rd step: Documentation

To take out an automobile insurance policy in Portugal, you must provide the following documents to your insurance company or broker

- Taxpayer’s ID number (Numero de contribuinte)

- A mailing address in Portugal

- A bank account number in Portugal

- Your driving history with bonuses/penalties (ask your former insurance company)

- The grey card for your vehicle now registered in Portugal or the official documentation proving you’ve applied for a change of registration through the Portuguese authorities.

Why can INOV Expat offer you good automobile insurance solutions?

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Spain, and now in Portugal, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex. So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free quote online: automobile, health, home, business, travel, other insurance. Check our website: pt.inovexpat.com or contact by email welcome@pt.inovexpat.com.

![]()