A

Acceleration Clause - The part of a contract that says when a loan may be declared due and payable.

Accidental Death Benefit - In a life insurance policy, benefit in addition to the death benefit paid to the beneficiary, should death occur due to an accident. There can be certain exclusions as well as time and age limits.

Active Participant - Person whose absence from a planned event would trigger a benefit if the event needs to be canceled or postponed.

Activities of Daily Living - Bathing, preparing and eating meals, moving from room to room, getting into and out of beds or chairs, dressing, using a toilet.

Actual Cash Value - Cost of replacing damaged or destroyed property with comparable new property, minus depreciation and obsolescence. For example, a 10-year-old sofa will not be replaced at current full value because of a decade of depreciation.

Actuary - A specialist in the mathematics of insurance who calculates rates, reserves, dividends and other statistics. (Americanism: In most other countries the individual is known as "mathematician.")

Adjustable Rate - An interest rate that changes, based on changes in a published market-rate index.

Adjuster - A representative of the insurer who seeks to determine the extent of the insurer's liability for loss when a claim is submitted.

Admitted Assets - Assets permitted by state law to be included in an insurance company's annual statement. These assets are an important factor when regulators measure insurance company solvency. They include mortgages, stocks, bonds and real estate.

Agent - individual who sells and services insurance policies in either of two classifications :

- Independent agent represents at least two insurance companies and (at least in theory) services clients by searching the market for the most advantageous price for the most coverage. The agent's commission is a percentage of each premium paid and includes a fee for servicing the insured's policy.

- Direct or career agent represents only one company and sells only its policies. This agent is paid on a commission basis in much the same manner as the independent agent.

Aggregate Limit - Usually refers to liability insurance and indicates the amount of coverage that the insured has under the contract for a specific period of time, usually the contract period, no matter how many separate accidents might occur.

Annual Administrative Fee - Charge for expenses associated with administering a group employee benefit plan.

Annual Crediting Cap - The maximum rate that the equity-indexed annuity can be credited in a year. If a contract has an upper limit, or cap, of 7 percent and the index linked to the annuity gained 7.2 percent, only 7 percent would be credited to the annuity.

Annuitization - Process by which you convert part or all of the money in a qualified retirement plan or nonqualified annuity contract into a stream of regular income payments, either for your lifetime or the lifetimes of you and your joint annuitant. Once you choose to annuitize, the payment schedule and the amount is generally fixed and can't be altered.

Annuitization Options - Choices in the way to annuitize. For example, life with a 10-year period certain means payouts will last a lifetime, but should the annuitant die during the first 10 years, the payments will continue to beneficiaries through the 10th year. Selection of such an option reduces the amount of the periodic payment.

Annuity - An agreement by an insurer to make periodic payments that continue during the survival of the annuitant(s) or for a specified period.

Approved for Reinsurance - Indicates the company is approved (or authorized) to write reinsurance on risks in this state. A license to write reinsurance might not be required in these states.

Approved or Not Disapproved for Surplus Lines - Indicates the company is approved (or not disapproved) to write excess or surplus lines in this state.

Assets - Assets refer to "all the available properties of every kind or possession of an insurance company that might be used to pay its debts." There are three classifications of assets: invested assets, all other assets, and total admitted assets. Invested assets refer to things such as bonds, stocks, cash and income-producing real estate. All other assets refer to nonincome producing possessions such as the building the company occupies, office furniture, and debts owed, usually in the form of deferred and unpaid premiums. Total admitted assets refer to everything a company owns. All other plus invested assets equals total admitted assets. By law, some states don't permit insurance companies to claim certain goods and possessions, such as deferred and unpaid premiums, in the all other assets category, declaring them "nonadmissable."

Attained Age - Insured's age at a particular time. For example, many term life insurance policies allow an insured to convert to permanent insurance without a physical examination at the insured's then attained age. Upon conversion, the premium usually rises substantially to reflect the insured's age and diminished life expectancy.

Authorized Under Federal Products Liability Risk Retention Act (Risk Retention Groups) - Indicates companies operating under the Federal Products Liability Risk Retention Act of 1981 and the Liability Risk Retention Act of 1986.

Automobile Liability Insurance - Coverage if an insured is legally liable for bodily injury or property damage caused by an automobile.

B

Balance Sheet - An accounting term referringto a listing of a company's assets, liabilities and surplus as of a specific date.

Benefit Period - In health insurance, the number of days for which benefits are paid to the named insured and his or her dependents. For example, the number of days that benefits are calculated for a calendar year consist of the days beginning on Jan. 1 and ending on Dec. 31 of each year.

Best's Capital Adequacy Relativity (BCAR) - This percentage measures a company's relative capital strength compared to its industry peer composite. A company's BCAR, which is an important component in determining the appropriateness of its rating, is calculated by dividing a company's capital adequacy ratio by the capital adequacy ratio of the median of its industry peer composite using Best's proprietary capital mode. Capital adequacy ratios are calculated as the net required capital necessary to support components of underwriting, asset, and credit risks in relation to economic surplus.

Broker - Insurance salesperson that searches the marketplace in the interest of clients, not insurance companies.

Broker-Agent - Independent insurance salesperson who represents particular insurers but also might function as a broker by searching the entire insurance market to place an applicant's coverage to maximize protection and minimize cost. This person is licensed as an agent and a broker.

Business Net Retention - This item represents the percentage of a company's gross writings that are retained for its own account. Gross writings are the sum of direct writings and assumed writings. This measure excludes affiliated writings.

C

Capital - Equity of shareholders of a stock insurance company. The company's capital and surplus are measured by the difference between its assets minus its liabilities. This value protects the interests of the company's policyowners in the event it develops financial problems; the policyowners' benefits are thus protected by the insurance company's capital. Shareholders' interest is second to that of policyowners.

Capitalization or Leverage - Measures the exposure of a company's surplus to various operating and financial practices. A highly leveraged, or poorly capitalized, company can show a high return on surplus, but might be exposed to a high risk of instability.

Captive Agent - Representative of a single insurer or fleet of insurers who is obliged to submit business only to that company, or at the very minimum, give that company first refusal rights on a sale. In exchange, that insurer usually provides its captive agents with an allowance for office expenses as well as an extensive list of employee benefits such as pensions, life insurance, health insurance, and credit unions.

Case Management - A system of coordinating medical services to treat a patient, improve care and reduce cost. A case manager coordinates health care delivery for patients.

Casualty - Liability or loss resulting from an accident.

Casualty Insurance - That type of insurance that is primarily concerned with losses caused by injuries to persons and legal liability imposed upon the insured for such injury or for damage to property of others. It also includes such diverse forms as plate glass, insurance against crime, such as robbery, burglary and forgery, boiler and machinery insurance and Aviation insurance. Many casualty companies also write surety business.

Ceded Reinsurance Leverage - The ratio of the reinsurance premiums ceded, plus net ceded reinsurance balances from non-US affiliates for paid losses, unpaid losses, incurred but not reported (IBNR), unearned premiums and commissions, less funds held from reinsurers, plus ceded reinsurance balances payable, to policyholders' surplus. This ratio measures the company's dependence upon the security provided by its reinsurers and its potential exposure to adjustment on such reinsurance.

Change in Net Premiums Written (IRIS) - The annual percentage change in Net Premiums Written. A company should demonstrate its ability to support controlled business growth with quality surplus growth from strong internal capital generation.

Change in Policyholder Surplus (IRIS) - The percentage change in policyholder surplus from the prior year-end derived from operating earnings, investment gains, net contributed capital and other miscellaneous sources. This ratio measures a company's ability to increase policyholders' security.

Chartered Property and Casualty Underwriter (CPCU) - Professional designation earned after the successful completion of 10 national examinations given by the American Institute for Property and Liability Underwriters. Covers such areas of expertise as insurance, risk management, economics, finance, management, accounting, and law. Three years of work experience also are required in the insurance business or a related area.

Claim - A demand made by the insured, or the insured's beneficiary, for payment of the benefits as provided by the policy.

Class 3-6 Bonds (% of PHS) - This test measures exposure to noninvestment grade bonds as a percentage of surplus. Generally, noninvestment grade bonds carry higher default and illiquidity risks. The designation of quality classifications that coincide with different bond ratings assigned by major credit rating agencies.

Coinsurance - In property insurance, requires the policyholder to carry insurance equal to a specified percentage of the value of property to receive full payment on a loss. For health insurance, it is a percentage of each claim above the deductible paid by the policyholder. For a 20% health insurance coinsurance clause, the policyholder pays for the deductible plus 20% of his covered losses. After paying 80% of losses up to a specified ceiling, the insurer starts paying 100% of losses.

Collision Insurance - Covers physical damage to the insured's automobile (other than that covered under comprehensive insurance) resulting from contact with another inanimate object.

Combined Ratio After Policyholder Dividends - The sum of the loss, expense and policyholder dividend ratios not reflecting investment income or income taxes. This ratio measures the company's overall underwriting profitability, and a combined ratio of less than 100 indicates an underwriting profit.

Commercial Lines - Refers to insurance for businesses, professionals and commercial establishments.

Commission - Fee paid to an agent or insurance salesperson as a percentage of the policy premium. The percentage varies widely depending on coverage, the insurer and the marketing methods.

Common Carrier - A business or agency that is available to the public for transportation of persons, goods or messages. Common carriers include trucking companies, bus lines and airlines.

Comprehensive Insurance - Auto insurance coverage providing protection in the event of physical damage (other than collision) or theft of the insured car. For example, fire damage or a cracked windshield would be covered under the comprehensive section.

Concurrent Periods - In hospital income protection, when a patient is confined to a hospital due to more than one injury and/or illness at the same time, benefits are paid as if the total disability resulted from only one cause.

Conditional Reserves - This item represents the aggregate of various reserves which, for technical reasons, are treated by companies as liabilities. Such reserves, which are similar to free resources or surplus, include unauthorized reinsurance, excess of statutory loss reserves over statement reserves, dividends to policyholders undeclared and other similar reserves established voluntarily or in compliance with statutory regulations.

Coverage - The scope of protection provided under an insurance policy. In property insurance, coverage lists perils insured against, properties covered, locations covered, individuals insured, and the limits of indemnification. In life insurance, living and death benefits are listed.

Convertible -Term life insurance coverage that can be converted into permanent insurance regardless of an insured's physical condition and without a medical examination. The individual cannot be denied coverage or charged an additional premium for any health problems.

Copayment - A predetermined, flat fee an individual pays for health-care services, in addition to what insurance covers. For example, some HMOs require a $10 copayment for each office visit, regardless of the type or level of services provided during the visit. Copayments are not usually specified by percentages.

Cost-of-Living Adjustment (COLA) - Automatic adjustment applied to Social Security retirement payments when the consumer price index increases at a rate of at least 3%, the first quarter of one year to the first quarter of the next year.

Coverage Area - The geographic region covered by travel insurance.

Creditable Coverage - Term means that benefits provided by other drug plans are at least as good as those provided by the new Medicare Part D program. This may be important to people eligible for Medicare Part D but who do not sign up at their first opportunity because if the other plans provide creditable coverage, plan members can later convert to Medicare Part D without paying higher premiums than those in effect during their open enrollment period.

Current Liquidity (IRIS) - The sum of cash, unaffiliated invested assets and encumbrances on other properties to net liabilities plus ceded reinsurance balances payable, expressed as a percent. This ratio measures the proportion of liabilities covered by unencumbered cash and unaffiliated investments. If this ratio is less than 100, the company's solvency is dependent on the collectibility or marketability of premium balances and investments in affiliates. This ratio assumes the collectibility of all amounts recoverable from reinsurers on paid and unpaid losses and unearned premiums.

D

Death Benefit - The limit of insurance or the amount of benefit that will be paid in the event of the death of a covered person.

Deductible - Amount of loss that the insured pays before the insurance kicks in.

Developed to Net Premiums Earned - The ratio of developed premiums through the year to net premiums earned. If premium growth was relatively steady, and the mix of business by line didn't materially change, this ratio measures whether or not a company's loss reserves are keeping pace with premium growth.

Development to Policyholder Surplus (IRIS) - The ratio measures reserve deficiency or redundancy in relation to policyholder surplus. This ratio reflects the degree to which year-end surplus was either overstated (+) or understated (-) in each of the past several years, if original reserves had been restated to reflect subsequent development through year end.

Direct Premiums Written - The aggregate amount of recorded originated premiums, other than reinsurance, written during the year, whether collected or not, at the close of the year, plus retrospective audit premium collections, after deducting all return premiums.

Direct Writer - An insurer whose distribution mechanism is either the direct selling system or the exclusive agency system.

Disease Management - A system of coordinated health-care interventions and communications for patients with certain illnesses.

Dividend - The return of part of the policy's premium for a policy issued on a participating basis by either a mutual or stock insurer. A portion of the surplus paid to the stockholders of a corporation.

E

Earned Premium - The amount of the premium that as been paid for in advance that has been "earned" by virtue of the fact that time has passed without claim. A three-year policy that has been paid in advance and is one year old would have only partly earned the premium.

Elimination Period - The time which must pass after filing a claim before policyholder can collect insurance benefits. Also known as "waiting period."

Employers Liability Insurance - Coverage against common law liability of an employer for accidents to employees, as distinguished from liability imposed by a workers' compensation law.

Encumbrance - A claim on property, such as a mortgage, a lien for work and materials, or a right of dower. The interest of the property owner is reduced by the amount of the encumbrance.

Exclusions - Items or conditions that are not covered by the general insurance contract.

Expense Ratio - The ratio of underwriting expenses (including commissions) to net premiums written. This ratio measures the company's operational efficiency in underwriting its book of business.

Exposure - Measure of vulnerability to loss, usually expressed in dollars or units.

Extended Replacement Cost - This option extends replacement cost loss settlement to personal property and to outdoor antennas, carpeting, domestic appliances, cloth awnings, and outdoor equipment, subject to limitations on certain kinds of personal property; includes inflation protection coverage.

F

File-and-Use Rating Laws - State-based laws which permit insurers to adopt new rates without the prior approval of the insurance department. Usually insurers submit their new rates with supporting statistical data.

Financing Entity - Provides money for purchases.

Floater -A separate policy available to cover the value of goods beyond the coverage of a standard renters insurance policy including movable property such as jewelry or sports equipment.

Future Purchase Option - Life and health insurance provisions that guarantee the insured the right to buy additional coverage without proving insurability. Also known as "guaranteed insurability option."

G

General Account - All premiums are paid into an insurer's general account. Thus, buyers are subject to credit-risk exposure to the insurance company, which is low but not zero.

General Liability Insurance -Insurance designed to protect business owners and operators from a wide variety of liability exposures. Exposures could include liability arising from accidents resulting from the insured's premises or operations, products sold by the insured, operations completed by the insured, and contractual liability.

Grace Period - The length of time (usually 31 days) after a premium is due and unpaid during which the policy, including all riders, remains in force. If a premium is paid during the grace period, the premium is considered to have been paid on time. In Universal Life policies, it typically provides for coverage to remain in force for 60 days following the date cash value becomes insufficient to support the payment of monthly insurance costs.

Gross Leverage - The sum of net leverage and ceded reinsurance leverage. This ratio measures a company's gross exposure to pricing errors in its current book of business, to errors of estimating its liabilities, and exposure to its reinsurers.

Guaranteed Insurability Option - See "future purchase option."

Guaranteed Issue Right - The right to purchase insurance without physical examination; the present and past physical condition of the applicant are not considered.

Guaranteed Renewable - A policy provision in many products which guarantees the policyowner the right to renew coverage at every policy anniversary date. The company does not have the right to cancel coverage except for nonpayment of premiums by the policyowner; however, the company can raise rates if they choose.

Guaranty Association - An organization of life insurance companies within a state responsible for covering the financial obligations of a member company that becomes insolvent.

H

Hazard - A circumstance that increases the likelihood or probable severity of a loss. For example, the storing of explosives in a home basement is a hazard that increases the probability of an explosion.

Hazardous Activity - Bungee jumping, scuba diving, horse riding and other activities not generally covered by standard insurance policies. For insurers that do provide cover for such activities, it is unlikely they will cover liability and personal accident, which should be provided by the company hosting the activity.

Health Maintenance Organization (HMO) - Prepaid group health insurance plan that entitles members to services of participating physicians, hospitals and clinics. Emphasis is on preventative medicine, and members must use contracted health-care providers.

Health Reimbursement Arrangement - Owners of high-deductible health plans who are not qualified for a health savings account can use an HRA.

Health Savings Account - Plan that allows you to contribute pre-tax money to be used for qualified medical expenses. HSAs, which are portable, must be linked to a high-deductible health insurance policy.

Hurricane Deductible - Amount you must pay out-of-pocket before hurricane insurance will kick in. Many insurers in hurricane-prone states are selling homeowners insurance policies with percentage deductibles for storm damage, instead of the traditional dollar deductibles used for claims such as fire and theft. Percentage deductibles vary from one percent of a home's insured value to 15 percent, depending on many factors that differ by state and insurer.

I

Impaired Insurer - An insurer which is in financial difficulty to the point where its ability to meet financial obligations or regulatory requirements is in question.

Indemnity - Restoration to the victim of a loss by payment, repair or replacement.

Independent Insurance Agents & Brokers of America (IIABA)

Formerly the Independent Insurance Agents of America (IIAA), this is a member organization of independent agents and brokers monitoring and affecting industry issues. Numerous state associations are affiliated with the IIABA.

Income Taxes - Incurred income taxes (including income taxes on capital gains) reported in each annual statement for that year.

Inflation Protection - An optional property coverage endorsement offered by some insurers that increases the policy's limits of insurance during the policy term to keep pace with inflation.

InovInsurance - Insurance broker dedicated to the expatriates in Spain

Insurable Interest - Interest in property such that loss or destruction of the property could cause a financial loss.

Insurance Adjuster - A representative of the insurer who seeks to determine the extent of the insurer's liability for loss when a claim is submitted. Independent insurance adjusters are hired by insurance companies on an "as needed" basis and might work for several insurance companies at the same time. Independent adjusters charge insurance companies both by the hour and by miles traveled. Public adjusters work for the insured in the settlement of claims and receive a percentage of the claim as their fee. A.M. Best's Directory of Recommended Insurance Attorneys and Adjusters lists independent adjusters only.

Insurance Attorneys - An attorney who practices the law as it relates to insurance matters. Attorneys might be solo practitioners or work as part of a law firm. Insurance companies who retain attorneys to defend them against law suits might hire staff attorneys to work for them in-house or they might retain attorneys on an as-needed basis. A.M. Best's Directory of Recommended Attorneys and Adjusters lists insurance defense attorneys who concentrate their practice in insurance defense such as coverage issues, bad faith, malpractice, products liability, and workers' compensation.

Insurance Institute of America (IIA) - An organization which develops programs and conducts national examinations in general insurance, risk management, management, adjusting, underwriting, auditing and loss control management.

Interest-Crediting Methods - There are at least 35 interest-crediting methods that insurers use. They usually involve some combination of point-to-point, annual reset, yield spread, averaging, or high water mark.

Investment Income - The return received by insurers from their investment portfolios including interest, dividends and realized capital gains on stocks. It doesn'tinclude the value of any stocks or bonds that the company currently owns.

Investments in Affiliates - Bonds, stocks, collateral loans, short-term investments in affiliated and real estate properties occupied by the company.

Insurance Regulatory Information System (IRIS) - Introduced by the National Association of Insurance Commissioners in 1974 to identify insurance companies that might require further regulatory review.

JKL

Laddering - Purchasing bond investments that mature at different time intervals.

Lapse Ratio - The ratio of the number of life insurance policies that lapsed within a given period to the number in force at the beginning of that period.

Least Expensive Alternative Treatment - The amount an insurance company will pay based on its determination of cost for a particular procedure.

Leverage or Capitalization - Measures the exposure of a company's surplus to various operating and financial practices. A highly leveraged, or poorly capitalized, company can show a high return on surplus, but might be exposed to a high risk of instability.

Liability - Broadly, any legally enforceable obligation. The term is most commonly used in a pecuniary sense.

Liability Insurance - Insurance that pays and renders service on behalf of an insured for loss arising out of his responsibility, due to negligence, to others imposed by law or assumed by contract.

Licensed - Indicates the company is incorporated (or chartered) in another state but is a licensed (admitted) insurer for this state to write specific lines of business for which it qualifies.

Licensed for Reinsurance Only - Indicates the company is a licensed (admitted) insurer to write reinsurance on risks in this state.

Lifetime Reserve Days - Sixty additional days Medicare pays for when you are hospitalized for more than 90 days in a benefit period. These days can only be used once during your lifetime. For each lifetime reserve day, Medicare pays all covered costs except for a daily coinsurance amount.

Liquidity - Liquidity is the ability of an individual or business to quickly convert assets into cash without incurring a considerable loss. There are two kinds of liquidity: quick and current. Quick liquidity refers to funds--cash, short-term investments, and government bonds--and possessions which can immediately be converted into cash in the case of an emergency. Current liquidity refers to current liquidity plus possessions such as real estate which cannot be immediately liquidated, but eventually can be sold and converted into cash. Quick liquidity is a subset of current liquidity. This reflects the financial stability of a company and thus their rating.

Living Benefits - This feature allows you, under certain circumstances, to receive the proceeds of your life insurance policy before you die. Such circumstances include terminal or catastrophic illness, the need for long-term care, or confinement to a nursing home. Also known as "accelerated death benefits."

Lloyd's - Generally refers to Lloyd's of London, England, an institution within which individual underwriters accept or reject the risks offered to them. The Lloyd's Corp. provides the support facility for their activities.

Lloyds Organizations - These organizations are voluntary unincorporated associations of individuals. Each individual assumes a specified portion of the liability under each policy issued. The underwriters operate through a common attorney-in-fact appointed for this purpose by the underwriters. The laws of most states contain some provisions governing the formation and operation of such organizations, but these laws don't generally provide as strict a supervision and control as the laws dealing with incorporated stock and mutual insurance companies.

Loss Adjustment Expenses - Expenses incurred to investigate and settle losses.

Loss and Loss-Adjustment Reserves to Policyholder Surplus Ratio - The higher the multiple of loss reserves to surplus, the more a company's solvency is dependent upon having and maintaining reserve adequacy.

Losses and Loss-Adjustment Expenses - This represents the total reserves for unpaid losses and loss-adjustment expenses, including reserves for any incurred but not reported losses, and supplemental reserves established by the company. It is the total for all lines of business and all accident years.

Loss Control - All methods taken to reduce the frequency and/or severity of losses including exposure avoidance, loss prevention, loss reduction, segregation of exposure units and noninsurance transfer of risk. A combination of risk control techniques with risk financing techniques forms the nucleus of a risk management program. The use of appropriate insurance, avoidance of risk, loss control, risk retention, self insuring, and other techniques that minimize the risks of a business, individual, or organization.

Loss Ratio - The ratio of incurred losses and loss-adjustment expenses to net premiums earned. This ratio measures the company's underlying profitability, or loss experience, on its total book of business.

Loss Reserve - The estimated liability, as it would appear in an insurer's financial statement, for unpaid insurance claims or losses that have occurred as of a given evaluation date. Usually includes losses incurred but not reported (IBNR), losses due but not yet paid, and amounts not yet due. For individual claims, the loss reserve is the estimate of what will ultimately be paid out on that claim.

Losses Incurred (Pure Losses) - Net paid losses during the current year plus the change in loss reserves since the prior year end.

M

Medical Loss Ratio - Total health benefits divided by total premium.

Member Month - Total number of health plan participants who are members for each month.

Mortality and Expense Risk Fees - A charge that covers such annuity contract guarantees as death benefits.

Mortgage Insurance Policy - In life and health insurance, a policy covering a mortgagor with benefits intended to pay off the balance due on a mortgage upon the insured's death, or to meet the payments due on a mortgage in case of the insured's death or disability.

Mutual Insurance Companies - Companies with no capital stock, and owned by policyholders. The earnings of the company--over and above the payments of the losses, operating expenses and reserves--are the property of the policyholders. There are two types of mutual insurance companies. A nonassessable mutual charges a fixed premium and the policyholders cannot be assessed further. Legal reserves and surplus are maintained to provide payment of all claims. Assessable mutuals are companies that charge an initial fixed premium and, if that isn't sufficient, might assess policyholders to meet losses in excess of the premiums that have been charged.

N

Named Perils - Perils specifically covered on insured property.

National Association of Insurance Commissioners (NAIC) - Association of state insurance commissioners whose purpose is to promote uniformity of insurance regulation, monitor insurance solvency and develop model laws for passage by state legislatures.

Net Income - The total after-tax earnings generated from operations and realized capital gains as reported in the company's NAIC annual statement on page 4, line 16.

Net Investment Income - This item represents investment income earned during the year less investment expenses and depreciation on real estate. Investment expenses are the expenses related to generating investment income and capital gains but exclude income taxes.

Net Leverage - The sum of a company's net premium written to policyholder surplus and net liabilities to policyholder surplus. This ratio measures the combination of a company's net exposure to pricing errors in its current book of business and errors of estimation in its net liabilities after reinsurance, in relation to policyholder surplus.

Net Liabilities to Policyholder Surplus - Net liabilities expressed as a ratio to policyholder surplus. Net liabilities equal total liabilities less conditional reserves, plus encumbrances on real estate, less the smaller of receivables from or payable to affiliates. This ratio measures company's exposures to errors of estimation in its loss reserves and all other liabilities. Loss-reserve leverage is generally the key component of net liability leverage. The higher the loss-reserve leverage the more critical a company's solvency depends upon maintaining reserve adequacy.

Net Premium - The amount of premium minus the agent's commission. Also, the premium necessary to cover only anticipated losses, before loading to cover other expenses.

Net Premiums Earned - The adjustment of net premiums written for the increase or decrease of the company's liability for unearned premiums during the year. When an insurance company's business increases from year to year, the earned premiums will usually be less than the written premiums. With the increased volume, the premiums are considered fully paid at the inception of the policy so that, at the end of a calendar period, the company must set up premiums representing the unexpired terms of the policies. On a decreasing volume, the reverse is true.

Net Premiums Written - Represents gross premium written, direct and reinsurance assumed, less reinsurance ceded.

Net Underwriting Income - Net premiums earned less incurred losses, loss-adjustment expenses, underwriting expenses incurred, and dividends to policyholders.

Nonstandard Auto (High Risk Auto or Substandard Auto) - Insurance for motorists who have poor driving records or have been canceled or refused insurance. The premium is much higher than standard auto due to the additional risks.

Net Premiums Written to Policyholder Surplus (IRIS) - This ratio measures a company's net retained premiums written after reinsurance assumed and ceded, in relation to its surplus. This ratio measures the company's exposure to pricing errors in its current book of business.

Non-Recourse Mortgage - A home loan in which the borrower can never owe more than the home's value at the time the loan is repaid.

Noncancellable - Contract terms, including costs that can never be changed.

O

Occurrence - An event that results in an insured loss. In some lines of business, such as liability, an occurrence is distinguished from accident in that the loss doesn't have to be sudden and fortuitous and can result from continuous or repeated exposure which results in bodily injury or property damage neither expected not intended by the insured.

Operating Cash Flow - Measures the funds generated from insurance operations, which includes the change in cash and invested assets attributed to underwriting activities, net investment income and federal income taxes. This measure excludes stockholder dividends, capital contributions, unrealized capital gains/losses and various noninsurance related transactions with affiliates. This test measures a company's ability to meet current obligations through the internal generation of funds from insurance operations. Negative balances might indicate unprofitable underwriting results or low yielding assets.

Operating Ratio (IRIS) - Combined ratio less the net investment income ratio (net investment income to net premiums earned). The operating ratio measures a company's overall operational profitability from underwriting and investment activities. This ratio doesn't reflect other operating income/expenses, capital gains or income taxes. An operating ratio of more than 100 indicates a company is unable to generate profits from its underwriting and investment activities.

Other Income/Expenses - This item represents miscellaneous sources of operating income or expenses that principally relate to premium finance income or charges for uncollectible premium and reinsurance business.

Out-of-Pocket Limit - A predetermined amount of money that an individual must pay before insurance will pay 100% for an individual's health-care expenses.

Overall Liquidity Ratio - Total admitted assets divided by total liabilities less conditional reserves. This ratio indicates a company's ability to cover net liabilities with total assets. This ratio doesn't address the quality and marketability of premium balances, affiliated investments and other uninvested assets.

Own Occupation - Insurance contract provision that allows policyholders to collect benefits if they can no longer work in their own occupation.

P

Paid-Up Additional Insurance - An option that allows the policyholder to use policy dividends and/or additional premiums to buy additional insurance on the same plan as the basic policy and at a face amount determined by the insured's attained age.

Participation Rate - In equity-indexed annuities, a participation rate determines how much of the gain in the index will be credited to the annuity. For example, the insurance company may set the participation rate at 80%, which means the annuity would only be credited with 80% of the gain experienced by the index.

Peril - The cause of a possible loss.

Personal Injury Protection - Pays basic expenses for an insured and his or her family in states with no-fault auto insurance. No-fault laws generally require drivers to carry both liability insurance and personal injury protection coverage to pay for basic needs of the insured, such as medical expenses, in the event of an accident.

Personal Lines - Insurance for individuals and families, such as private-passenger auto and homeowners insurance.

Point-of-Service Plan - Health insurance policy that allows the employee to choose between in-network and out-of-network care each time medical treatment is needed.

Policy - The written contract effecting insurance, or the certificate thereof, by whatever name called, and including all clause, riders, endorsements, and papers attached thereto and made a part thereof.

Policyholder Dividend Ratio - The ratio of dividends to policyholders related to net premiums earned.

Policyholder Surplus - The sum of paid in capital, paid in and contributed surplus, and net earned surplus, including voluntary contingency reserves. It also is the difference between total admitted assets and total liabilities.

Policy or Sales Illustration - Material used by an agent and insurer to show how a policy may perform under a variety of conditions and over a number of years.

Pre-Existing Condition - A coverage limitation included in many health policies which states that certain physical or mental conditions, either previously diagnosed or which would normally be expected to require treatment prior to issue, will not be covered under the new policy for a specified period of time.

Preferred Auto - Auto coverage for drivers who have never had an accident and operates vehicles according to law. Drivers are not a risk for any insurance company that writes auto insurance, and no insurance company would be afraid to take them on as risk.

Preferred Provider Organization - Network of medical providers who charge on a fee-for-service basis, but are paid on a negotiated, discounted fee schedule.

Premium - The price of insurance protection for a specified risk for a specified period of time.

Premium Balances - Premiums and agents' balances in course of collection; premiums, agents' balances and installments booked but deferred and not yet due; bills receivable, taken for premiums and accrued retrospective premiums.

Premium Earned - The amount of the premium that as been paid for in advance that has been "earned" by virtue of the fact that time has passed without claim. A three-year policy that has been paid in advance and is one year old would have only partly earned the premium.

Premium to Surplus Ratio - This ratio is designed to measure the ability of the insurer to absorb above-average losses and the insurer's financial strength. The ratio is computed by dividing net premiums written by surplus. An insurance company's surplus is the amount by which assets exceed liabilities. The ratio is computed by dividing net premiums written by surplus. For example, a company with $2 in net premiums written for every $1 of surplus has a 2-to-1 premium to surplus ratio. The lower the ratio, the greater the company's financial strength. State regulators have established a premium-to-surplus ratio of no higher than 3-to-1 as a guideline.

Premium Unearned - That part of the premium applicable to the unexpired part of the policy period.

Pretax Operating Income - Pretax operating earnings before any capital gains generated from underwriting, investment and other miscellaneous operating sources.

Pretax Return on Revenue - A measure of a company's operating profitability and is calculated by dividing pretax operating earnings by net premiums earned.

Private-Passenger Auto Insurance Policyholder Risk Profile - This refers to the risk profile of auto insurance policyholders and can be divided into three categories: standard, nonstandard and preferred. In the eyes of an insurance company, it is the type of business (or the quality of driver) that the company has chosen to taken on.

Profit - A measure of the competence and ability of management to provide viable insurance products at competitive prices and maintain a financially strong company for both policyholders and stockholders.

Protected Cell Company (PCC) - A PCC is a single legal entity that operates segregated accounts, or cells, each of which is legally protected from the liabilities of the company's other accounts. An individual client's account is insulated from the gains and losses of other accounts, such that the PCC sponsor and each client are protected against liquidation activities by creditors in the event of insolvency of another client.

Q

Qualified High-Deductible Health Plan - A health plan with lower premiums that covers health-care expenses only after the insured has paid each year a large amount out of pocket or from another source. To qualify as a health plan coupled with a Health Savings Account, the Internal Revenue Code requires the deductible to be at least $1,000 for an individual and $2,000 for a family. High-deductible plans are also known as catastrophic plans.

Qualified Versus Non-Qualified Policies - Qualified plans are those employee benefit plans that meet Internal Revenue Service requirements as stated in IRS Code Section 401a. When a plan is approved, contributions made by the employer are tax deductible expenses.

Qualifying Event - An occurrence that triggers an insured's protection.

Quick Assets - Assets that are quickly convertible into cash.

Quick Liquidity Ratio - Quick assets divided by net liabilities plus ceded reinsurance balances payable. Quick assets are defined as the sum of cash, unaffiliated short-term investments, unaffiliated bonds maturing within one year, government bonds maturing within five years, and 80% of unaffiliated common stocks. These assets can be quickly converted into cash in the case of an emergency.

R

Reciprocal Insurance Exchange - An unincorporated groups of individuals, firms or corporations, commonly termed subscribers, who mutually insure one another, each separately assuming his or her share of each risk. Its chief administrator is an attorney-in-fact.

Re-Entry- Re-entry, which is the allowance for level-premium term policyowners to qualify for another level-premium period, generally with new evidence of insurability.

Reinsurance - In effect, insurance that an insurance company buys for its own protection. The risk of loss is spread so a disproportionately large loss under a single policy doesn't fall on one company. Reinsurance enables an insurance company to expand its capacity; stabilize its underwriting results; finance its expanding volume; secure catastrophe protection against shock losses; withdraw from a line of business or a geographical area within a specified time period.

Reinsurance Ceded - The unit of insurance transferred to a reinsurer by a ceding company.

Reinsurance Recoverables to Policyholder Surplus - Measures a company's dependence upon its reinsurers and the potential exposure to adjustments on such reinsurance. Its determined from the total ceded reinsurance recoverables due from non-U.S. affiliates for paid losses, unpaid losses, losses incurred but not reported (IBNR), unearned premiums and commissions less funds held from reinsurers expressed as a percent of policyholder surplus.

Renewal - The automatic re-establishment of in-force status effected by the payment of another premium.

Replacement Cost - The dollar amount needed to replace damaged personal property or dwelling property without deducting for depreciation but limited by the maximum dollar amount shown on the declarations page of the policy.

Reserve - An amount representing actual or potential liabilities kept by an insurer to cover debts to policyholders. A reserve is usually treated as a liability.

Residual Benefit - In disability insurance, a benefit paid when you suffer a loss of income due to a covered disability or if loss of income persists. This benefit is based on a formula specified in your policy and it is generally a percentage of the full benefit. It may be paid up to the maximum benefit period.

Return on Policyholder Surplus (Return on Equity) - The sum of after-tax net income and unrealized capital gains, to the mean of prior and current year-end policyholder surplus, expressed as a percent. This ratio measures a company's overall after-tax profitability from underwriting and investment activity.

Risk Class - Risk class, in insurance underwriting, is a grouping of insureds with a similar level of risk. Typical underwriting classifications are preferred, standard and substandard, smoking and nonsmoking, male and female.

Risk Management - Management of the pure risks to which a company might be subject. It involves analyzing all exposures to the possibility of loss and determining how to handle these exposures through practices such as avoiding the risk, retaining the risk, reducing the risk, or transferring the risk, usually by insurance.

Risk Retention Groups - Liability insurance companies owned by their policyholders. Membership is limited to people in the same business or activity, which exposes them to similar liability risks. The purpose is to assume and spread liability exposure to group members and to provide an alternative risk financing mechanism for liability. These entities are formed under the Liability Risk Retention Act of 1986. Under law, risk retention groups are precluded from writing certain coverages, most notably property lines and workers' compensation. They predominately write medical malpractice, general liability, professional liability, products liability and excess liability coverages. They can be formed as a mutual or stock company, or a reciprocal.

S

Secondary Market - The secondary market is populated by buyers willing to pay what they determine to be fair market value.

Section 1035 Exchange - This refers to a part of the Internal Revenue Code that allows owners to replace a life insurance or annuity policy without creating a taxable event.

Section 7702 - Part of the Internal Revenue Code that defines the conditions a life policy must satisfy to qualify as a life insurance contract, which has tax advantages.

Separate Account - A separate account is an investment option that is maintained separately from an insurer's general account. Investment risk associated with separate-account investments is born by the contract owner.

Solvency - Having sufficient assets--capital, surplus, reserves--and being able to satisfy financial requirements--investments, annual reports, examinations--to be eligible to transact insurance business and meet liabilities.

Standard Auto - Auto insurance for average drivers with relatively few accidents during lifetime.

State of Domicile - The state in which the company is incorporated or chartered. The company also is licensed (admitted) under the state's insurance statutes for those lines of business for which it qualifies.

Statutory Reserve - A reserve, either specific or general, required by law.

Stock Insurance Company - An incorporated insurer with capital contributed by stockholders, to whom earnings are distributed as dividends on their shares.

Stop Loss - Any provision in a policy designed to cut off an insurer's losses at a given point.

Subaccount Charge - The fee to manage a subaccount, which is an investment option in variable products that is separate from the general account.

Subrogation - The right of an insurer who has taken over another's loss also to take over the other person's right to pursue remedies against a third party.

Successive Periods - In hospital income protection, when confinements in a hospital are due to the same or related causes and are separated by less than a contractually stipulated period of time, they are considered part of the same period of confinement.

Surplus - The amount by which assets exceed liabilities.

Surrender Charge - Fee charged to a policyholder when a life insurance policy or annuity is surrendered for its cash value. This fee reflects expenses the insurance company incurs by placing the policy on its books, and subsequent administrative expenses.

Surrender Period - A set amount of time during which you have to keep the majority of your money in an annuity contract. Most surrender periods last from five to 10 years. Most contracts will allow you to take out at least 10% a year of the accumulated value of the account, even during the surrender period. If you take out more than that 10%, you will have to pay a surrender charge on the amount that you have withdrawn above that 10%.

T

Term Life Insurance - Life insurance that provides protection for a specified period of time. Common policy periods are one year, five years, 10 years or until the insured reaches age 65 or 70. The policy doesn't build up any of the nonforfeiture values associated with whole life policies.

Tort - A private wrong, independent of contract and committed against an individual, which gives rise to a legal liability and is adjudicated in a civil court. A tort can be either intentional or unintentional, and liability insurance is mainly purchased to cover unintentional torts.

Total Admitted Assets - This item is the sum of all admitted assets, and are valued in accordance with state laws and regulations, as reported by the company in its financial statements filed with state insurance regulatory authorities. This item is reported net as to encumbrances on real estate (the amount of any encumbrances on real estate is deducted from the value of the real estate) and net as to amounts recoverable from reinsurers (which are deducted from the corresponding liabilities for unpaid losses and unearned premiums).

Total Annual Loan Cost - The projected annual average cost of a reverse mortgage including all itemized costs.

Total Loss - A loss of sufficient size that it can be said no value is left. The complete destruction of the property. The term also is used to mean a loss requiring the maximum amount a policy will pay.

U

Umbrella Policy - Coverage for losses above the limit of an underlying policy or policies such as homeowners and auto insurance. While it applies to losses over the dollar amount in the underlying policies, terms of coverage are sometimes broader than those of underlying policies.

Unaffiliated Investments - These investments represent total unaffiliated investments as reported in the exhibit of admitted assets. It is cash, bonds, stocks, mortgages, real estate and accrued interest, excluding investment in affiliates and real estate properties occupied by the company.

Underwriter - The individual trained in evaluating risks and determining rates and coverages for them. Also, an insurer.

Underwriting - The process of selecting risks for insurance and classifying them according to their degrees of insurability so that the appropriate rates may be assigned. The process also includes rejection of those risks that do not qualify.

Underwriting Expenses Incurred - Expenses, including net commissions, salaries and advertising costs, which are attributable to the production of net premiums written.

Underwriting Expense Ratio - This represents the percentage of a company's net premiums written that went toward underwriting expenses, such as commissions to agents and brokers, state and municipal taxes, salaries, employee benefits and other operating costs. The ratio is computed by dividing underwriting expenses by net premiums written. The ratio is computed by dividing underwriting expenses by net premiums written. A company with an underwriting expense ratio of 31.3% is spending more than 31 cents of every dollar of net premiums written to pay underwriting costs. It should be noted that different lines of business have intrinsically differing expense ratios. For example, boiler and machinery insurance, which requires a corps of skilled inspectors, is a high expense ratio line. On the other hand, expense ratios are usually low on group health insurance.

Underwriting Guide - Details the underwriting practices of an insurance company and provides specific guidance as to how underwriters should analyze all of the various types of applicants they might encounter. Alsocalled an underwriting manual, underwriting guidelines, or manual of underwriting policy.

Unearned Premiums - That part of the premium applicable to the unexpired part of the policy period.

Uninsured Motorist Coverage - Endorsement to a personal automobile policy that covers an insured collision with a driver who does not have liability insurance.

Universal Life Insurance - A combination flexible premium, adjustable life insurance policy.

Usual, Customary and Reasonable Fees - An amount customarily charged for or covered for similar services and supplies which are medically necessary, recommended by a doctor or required for treatment.

Utilization - How much a covered group uses a particular health plan or program.

V

Valuation - A calculation of the policy reserve in life insurance. Also, a mathematical analysis of the financial condition of a pension plan.

Valuation Reserve - A reserve against the contingency that the valuation of assets, particularly investments, might be higher than what can be actually realized or that a liability may turn out to be greater than the valuation placed on it.

Variable Annuitization - The act of converting a variable annuity from the accumulation phase to the payout phase.

Variable Life Insurance - A form of life insurance whose face value fluctuates depending upon the value of the dollar, securities or other equity products supporting the policy at the time payment is due.

Variable Universal Life Insurance - A combination of the features of variable life insurance and universal life insurance under the same contract. Benefits are variable based on the value of underlying equity investments, and premiums and benefits are adjustable at the option of the policyholder.

Viatical Settlement Provider - Someone who serves as a sales agent, but does not actually purchase policies.

Viator - The terminally ill person who sells his or her life insurance policy.

Voluntary Reserve - An allocation of surplus not required by law. Insurers often accumulate such reserves to strengthen their financial structure.

W

Waiting Period - See "elimination period."

Waiver of Premium - A provision in some insurance contracts which enables an insurance company to waive the collection of premiums while keeping the policy in force if the policyholder becomes unable to work because of an accident or injury. The waiver of premium for disability remains in effect as long as the ensured is disabled.

Whole Life Insurance - Life insurance which might be kept in force for a person's whole life and which pays a benefit upon the person's death, whenever that might be.

XYZ

Yield on Invested Assets (IRIS) - Annual net investment income after expenses, divided by the mean of cash and net invested assets. This ratio measures the average return on a company's invested assets. This ratio is before capital gains/losses and income taxes.

Search

Articles

Home Insurance: Policies through your bank

Home Insurance: Policies through your bank

You’ve just signed a mortgage with your new Portuguese bank and your banking advisor suggests you also take out home insurance at the same time to take advantage of a great interest rate… Is it a good or bad idea?

It’s sure an easy way to finish up all the paperwork (which is cumbersome for everyone!) once and for all. But, it also means quickly forgetting that your commercial relationship with the bank when you sign a mortgage does not require also taking out home insurance with the same bank, even if you’re being lured with a lower interest rate. It’s all a question of common sense and priorities…

If you actually come out winning on the cost of the loan with a “loan/insurance package”, this option may make sense; however, you must still make sure you know what’s included in the home insurance cover signed.

To be honest, insurance offered by banks is often more expensive than the products offered by certain insurance companies. Always compare before signing!

Understanding to make a better choice

If your banking advisor proposes lowering the interest rate subject to signing home insurance with their agency, that means they already have the commercial capacity to offer a lower rate: it’s up to you to negotiate!

Banks have to diversify the products they sell to their customers so they become “locked in”, loyal and less likely to think about switching to the competition due to all the administrative constraints which can be daunting at times. But, bear in mind you also have a commercial relationship with your bank. If you wish to make good choices, it’s always best to take your time and compare offers not only in terms of costs, but, also and above all, the types of guarantees covered by each offer.

Yet, spending time comparing or negotiating is clearly a loss of time for many of us expatriates and we often prefer to accept the packages proposed by our banks.

So, here’s a little advice… Take your time before signing and compare different banks to check the quality of their offers.

Home insurance suggested by your banking advisor is never mandatory, but it can influence the rate on your loan… Even still, make sure you have all the information on the cover offered as well as the prices charged for the same insurance by the competition.

> By now, you probably understand that we advise you to never act too soon on insurance but rather inform yourself well with regard to the prices charged by the competition on the home insurance market in Portugal.

To help you with your loan negotiations, you should know the “real market price” of home insurance: the best way is to seek the advice of a broker.

INOV Expat, for example, is an insurance brokerage firm that has specialised for 14 years in insurance for English and French expatriates in Spain, and now in Portugal, at their destinations.

INOV Expat specialists answer all your questions for free and can quickly provide you with 3 comparative quotes based on your needs, your profile and your situation: ask for a free quote online (now). And more than just receiving advice, INOV Expat assists you with its insurance professionals.

In fact, in the event of a claim, a broker like INOV Expat is there to file and manage it, find a way to quickly help you (repairs, taxis… depending on the incident, etc.) and, especially when needed, defend your rights as a customer against the insurance company. Note that INOV Expat and all of its collaborators are expatriates: so, they are particularly knowledgeable of your problems and are all multilingual.

So, you’ve got a question about the home insurance you took out with your bank: don’t panic as you’ve got time to compare and you can cancel it upon the renewal date if necessary just like in England!

Why can INOV Expat really help me with my insurance?

You probably now understand that insuring you property means taking the time to ask good questions and compare offers. But, it’s not always so easy to know who to trust with these types of guarantees when you arrive in a new country and haven’t got the time to handle all the administrative issues and even less so when you still aren’t proficient in the language…

INOV Expat is right there to help you: giving you the best advice on insurance, in English and for free!

In fact, after 14 years, INOV Expat, an insurance brokerage firm, specialises in insurance for French and English-speaking expatriates in Spain, and now in Portugal, at their destinations. As insurance professionals, we’ve signed partnership agreements with the best insurance companies in the market. All INOV Expat consultants are expatriates who will be able to advise you best in the language of your choice.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Check our website: pt.inovexpat.com or contact us by email at welcome@inovexpat.com.

![]()

Why take out Travel Insurance?

Why take out Travel Insurance?

Traveling is about having adventures… But, sometimes there are troubles too: flight cancellations and delays, lost luggage, a stolen passport, health issues… Whether on business or traveling for pleasure, a trip abroad can become a nightmare with major unexpected costs.

Travel insurance is all about taking off with peace of mind

There are several formulas that cover the following risks in particular:

- Medical, surgery and hospitalisation fees up to €100,000

- Unlimited repatriation costs

- Other options may cover lost luggage, trip cancellation costs, dental emergencies and civil liability abroad (including material damages and bodily harm) caused to third parties during your stay

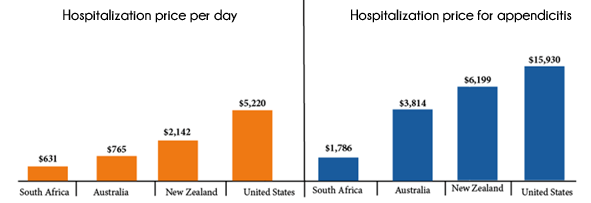

Here are two examples of healthcare costs at different destinations:

We always advise you to adapt your travel insurance policy to your “traveller” profile:

- For those who worry more about medical care (covering medical costs while traveling as well as repatriation), you should choose a medical care

- For travellers looking for expanded cover for all risks during travel, then multi-risk travel insurance should be the choice

- Travel insurance plans are custom-designed and adapt to your needs, whether a short or long stay or a business, family or adventure trip

From the duration to the type of stay to the adapted guarantees, there are so many different options based on your destination and coverage needs. For frequent travellers and those who’d like to insure all the members of their family, there are also annual and family plans.

> Our advice when it comes to travel insurance: don’t act too quickly and take time to analyse the cover offered in relation to your “traveller” profile !

What are the covers and benefits of annual travel insurance?

This is the most complete travel insurance. It particularly covers the following:

- Medical costs abroad (medical care, surgery and hospitalisation) up to €100,000

- Emergency dental care

- Repatriation or medical transfers without any cost ceilings

- Extended stays due to illness or an accident

- Travel and accommodation fees for a family member in the event of an illness or accident

- An early return in the event of the death or the non-scheduled hospitalisation of a close family member

- Luggage search and delivery if lost

- Interpreter services for an emergency situation

What is the price for… annual travel insurance?

To travel with complete peace of mind, we strongly advice taking out a travel insurance policy… When the average cost of travel insurance for 15 days is €50, it seems quite reasonable to include this cost in your holiday budget.

Irrespective of the duration of your trip, your destination or the number of people to be insured, we’re there to find the best travel insurance for you.

> So, get your free quote by clicking right here!

INOV Expat – About Us

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Spain, and now in Portugal, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex.

So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at welcome@inovexpat.com.

![]()

Health Insurance in Portugal: How It Works

Health Insurance in Portugal: How It Works

Beyond the tax benefits for pensioners, Portugal is attracting more and more European workers who are coming to work, develop a business and enjoy an excellent quality of life and some of the best sun in Europe. Some 500,000 French workers have chosen this new life as counted at the beginning of 2018, which is 5 times more than recorded in 2014! Yet the tempting adventure of expatriation also comes with certain administrative hassles and the issue of medical coverage should always get careful attention. In fact, the Portuguese healthcare system may be disconcerting to the English, who are used to a bit of freedom of choice when it comes to doctors and possible reimbursement even when using the private system. How does the Portuguese healthcare system work?

Are there any links between the private and public healthcare systems like in England?

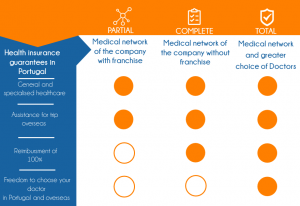

Partial Cover

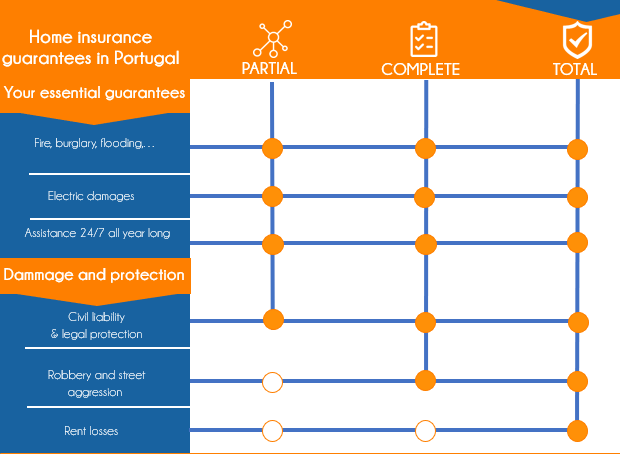

This is the basic formula which allows access to an insurance company-approved network of doctors with a small payment per service (deductible) for:

- general medicine or specialist consultations,

- hospital care,

- healthcare when traveling abroad.

Full Cover

With this formula, patients have access to the company’s medical network without any deductibles: consultations are 100% covered by the company and the insured also benefits from travel insurance when abroad.

Complete Cover

This is the most expensive type of policy but also the one that guarantees the best cover for your and your family’s health in Portugal! And depending on your needs, complete cover is an investment that can be quickly returned. In fact, besides giving you access to a large network of practitioners approved by the insurance company in general and specialist medicine, this health insurance particularly ensures 100% payment of all visits and offers hospital care as well as travel assistance when abroad.

And if a physician outside the company’s network must be consulted either in Portugal or abroad, 80% of the advance fees will be covered by the company.

If you’re not very comfortable speaking Portuguese or are hesitant to express yourself in another language when discussing a healthcare issue, the COMPLETE policy is just for you: it allows access to English-speaking generalists and specialists. The COMPLETE policy also covers alternative medicine consultations: acupuncture, homeopathy, osteopathy are some of the rather costly practices covered by this policy.

Ask for your free quote for health insurance -> CLICK HERE

INOV Expat – About Us

INOV Expat is an insurance brokerage firm aimed at French and English-speaking expatriates in Spain, and now in Portugal, which has signed partnership agreements with the leading insurance companies on the market. We know just how much moving to another country can bring about a lot of surprises and procedures which are sometimes quite complex. So, ever since its foundation in 2004, INOV Expat has not only aimed to assist its expatriate clients search for “custom insurance” but also defend their rights in the event of a claim.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance. Contact us by email at welcome@inovexpat.com.

![]()

Guide to Home Insurance in Portugal

Guide to Home Insurance in Portugal

You’ve made the decision. You’re moving to Portugal and are going to take total advantage of its relaxed way of life, sun, beaches, golf courses… But before going any further, it’s best to have all the administrative issues straight like home insurance! Whether you’re renting or own your new home, you must ask yourself a few good questions in order to insure it: “What’s the process? What’s the cost? With who? Read our Guide to Home Insurance in Portugal for the answers.

Why get home insurance in Portugal?

Because, just like when you’re in England, your new home won’t be completely safe from a leak, a burglary or a weather event that may damage the structure and/or the property in your home…

Whether an owner or tenant, home insurance brings peace of mind: it guarantees the structure of your home as well as your possessions in addition to covering the civil liability of the occupants and even that of your 4-legged friends!

I heard home insurance is not mandatory in Portugal

That’s true… As a tenant in Portugal, you have no obligation to take out home insurance. However, home owners are required to insure their assets against the risk of fire and the property manager must ensure the common areas are covered by insurance.

So, why should I insure my home in Portugal if it’s not mandatory?

For peace of mind and to guarantee peaceful relations with your neighbours and with your landlord!

In fact, no one is completely safe from a burglary or a “minor everyday accident” (an overflowing bathtub, a leaking washing machine…) that may damage your home as well as your neighbours’ homes. When that happens, who pays for the repairs and at what cost? Without home insurance, you may quickly find yourself in a conflictive situation and you still may not really be proficient in your host country’s language! Insuring your home is all about investing in a guarantee of peace, especially when you’re abroad.

What other benefits are there to home insurance?

Home insurance is much more than just insuring your furniture … In fact, home insurance is also known as home multi-risk. This means it covers all sorts of risks ranging from breaking and entering to fire, water damage and electrical damage following a big storm… And even Civil Liability (CL) for the insured and the people declared under the same roof.

Civil Liability covers all bodily injuries and material and non-material damages caused to another person in one’s private life.

Did you know?

In Portugal, it is quite easy to find qualified domestic help at a much lower cost than in England: cleaners, childcare, gardeners, etc. But, did you know that you are required to take out occupational accident insurance to cover your employees when working in your home as well as when they’re traveling to and from work?

Get more information from our INOV Expat specialists…

To better understand your premium, you need to know how it’s calculated and ask a few good questions :

-

Do you rent or own your home in Portugal?

If you’re the home owner… The premium is generally higher as the cover is broader: it even includes structural insurance, for example. If you’re the home owner and occupant, insurance may also cover the furniture.

-

Is it your primary or secondary residence?

If it’s a secondary residence which is only occupied a few weeks a year, the premium will be higher! In fact, the risk of a potential theft increases when your property has no surveillance or occupants for long periods of time and that is why the premium is higher. Other factors will also influence the cost of the premium: the surface area of the home, outbuildings, a swimming pool…

-

Where do you live?

Your place of residence has a significant impact on the cost of your premium. Insurance companies cover risks by calculating based on objective statistical data as far as the number of reported violations in the surrounding area. The premium should be less in a rural area in comparison to a home in an urban area.

-

Is it a house, a flat… big or small?

The premium for your home insurance is calculated based on the number of rooms to be insured. For example, a studio flat in the Chiado district in Lisbon would be less expensive to insure than a family home with a swimming pool and an outbuilding in Cascais or Faro since the risk of damage is statistically lower… Insurance companies also take into account the value of the fixed assets (owner) and non-fixed assets (tenant) at the property to be insured.

To get an idea of the different offers, here’s a little diagram with the 3 main types of home insurance policies you may find in Portugal :

What about buying a home… is it really all that complicated in Portugal?

Rather than renting, you’d prefer to take advantage of the buoyant estate situation and relatively affordable prices by investing in a new home…

The various steps:

-

Get assistance from a professional

Finding a local representative (an attorney, an agent broker or a Portuguese notary) is essential given the various steps that must be taken if you wish to buy and even more so if you aren’t proficient in Portuguese.

-

Conservatora do registo Predial

Once you’ve found your dream home, the land registry (Conservatora do registo Predial) must be checked to ensure the ownership status is correct without any burdens or mortgages that may get in the way of the sale.

-

Get a Taxpayer’s Number (Finanças)

This is a card that shows your taxpayer’s number. This document is essential to pay your annual property taxes but also for certain everyday tasks like opening an account with a Portuguese bank.

-

Cadastre (Carderneta Predial)

It is important to check with the local cadastre to ensure all the information registered corresponds with the information you’ve been given – number of rooms, surface area of the property, surface area of the garden, etc.

-

Promise to Sell (Contracto de Compra e Venda)

At this point, you’ll probably need to pay the seller (via their attorney) a deposit of 10% of the purchase price. The corresponding contract may be signed before a notary or an attorney.

-

Transfer duties= IMT (formerly known as SISA)

IMT is the Portuguese property transfer duty and it must be paid before signing the bill of sale. The sum varies based on the property value.

- Property taxes (IMI)

Careful! Before signing any actual bill of sale, you must have your attorney or representative verify the seller is current on property taxes (for the last 5 years) … or you’ll be at risk of having to pay them yourself.

- Definitive bill of sale (Escritura)

The land patent is issued along with the definitive bill of transfer which is signed at a notary’s office.

- Registration

The transfer of ownership must be registered with the local land registry so your name is listed as the new owner.

Why choose INOV Expat to help you choose your home insurance in Portugal?

You probably now understand that insuring you property means taking the time to ask good questions and compare offers. But, it’s not always so easy to know who to trust with these types of guarantees when you arrive in a new country and haven’t got the time to handle all the administrative issues and even less so when you still aren’t proficient in the language…

INOV Expat is right there to meet this need: giving you the best advice on insurance, in English and for free! In fact, after 14 years, INOV Expat, an insurance brokerage firm, specialises in insurance for French and English-speaking expatriates in Spain, and now in Portugal, at their destinations. As insurance professionals, we’ve signed partnership agreements with the best insurance companies in the market.

All INOV Expat consultants are expatriates who perfectly understand your problems and are there for you to offer free advice in the language of your choice.

Ask for your free online quote: automobile, health, home, business, travel, or other insurance or contact us by email at welcome@.inovexpat.com.

![]()

Healthcare in Portugal

Healthcare in Portugal